Other important information

PPA’s Fees and Charges

There are fees and charges involved and you are advised to consider them before contributing to the scheme. The table below provides PPA’s fees in respect to your PRS account.

Provider’s Fees and Charges

There may be differences in fees and charges amongst the PRS Providers. The list below provides some of the general fees charged by the PRS Providers.

• Sales charge – to pay for marketing and servicing services

• Annual management fee – to pay for investment management services

• Transaction fees i.e. switching fee, transfer fee and redemption charge – to pay for administration of your transaction

To find out more on each individual PRS Provider’s fees and charges or to make a fee comparison, please go to PRS Providers & Schemes section.

Investment Risks

When you invest in a PRS Fund, there are investment risks involved. These are general risks which you will be exposed to when investing in any of the PRS Funds as well as specific risks associated with the investment portfolio of each PRS Fund. Therefore you should consider the different type of risks that may affect you and the fund. These risks are disclosed in the PRS Scheme Disclosure Document or Product Highlights Sheet.

For a list of the PRS fund’s general and specific risks with your respective PRS Provider, please go to Funds & Providers section. Alternatively, you may contact any of the PRS Providers and ask for a copy of their PRS Scheme Disclosure Document or Product Highlights Sheet.

About PRS Funds

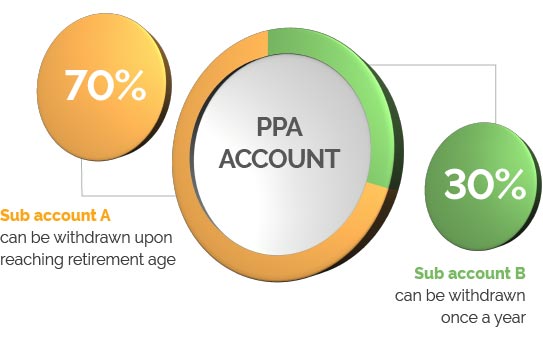

Any individual who has attained the age of 18 years as of the date of the account opening of a private pension account may make a contribution to any fund under the PRS. The PRS is offered to Malaysians and non-Malaysians as well. Contributions to any fund under the PRS will be maintained in two separate sub-accounts by the PRS Providers as follows:

- 70% in Sub-account A which is not available for pre-retirement withdrawal; and

- 30% in Sub-account B which would be available for pre-retirement withdrawal subject to payment of 8% tax penalty on the withdrawal sum.

Individuals have the option to contribute to more than one fund under a PRS scheme or to contribute to more than one PRS scheme, offered by different PRS Providers.

Being a voluntary scheme, there are no fixed amounts or fixed intervals for making contributions. You may wish to make regular contributions or lump sum contributions. Please note that there may be differences in the minimum initial contribution amount and subsequent contribution amount amongst the PRS Providers.

Once you have opened your PRS account, you could top up your contributions by using PRS Online from your smartphones, tablet or computer. Find out more about PRS Online Top Up service.

When you make contribution in a PRS for the first time, you are given a cooling-off right to obtain a refund of your investment in the fund, within the cooling-off period of not less than six (6) business days commencing from the date of receipt of the application by the PRS Provider.

You can enjoy tax relief on your gross contribution, i.e. inclusive of upfront charges. For example, if an individual invested RM3,000 with a Provider and that Provider deducted RM10 for account opening fee, and RM50 for sales charge, the full RM3,000 is eligible for tax relief, and not RM2,940.

Tax relief of up to RM3,000 per annum will be applied on taxable income, for individual on contributions made to the PRS from assessment year 2012 to 2025. Individuals may claim their individual tax relief or the PRS under Section F-F18 of the BE Form. Contribution statements to support the claim for tax relief may be obtained from the Provider as proof of investment made for the year of assessment.

PRS offers contributors the choice and flexibility to switch their fund if they underperform expectations and/or even transfer their funds to another Provider. This will ensure that the contributor’s retirement and investment objectives are aligned, not mismatched and ultimately realised.

Switching occurs when a Member requests for a transfer of the existing PRS fund invested in to another PRS fund in the PRS scheme of the same PRS Provider.

Transfer occurs when a Member requests for a transfer of the existing PRS fund invested in to another PRS fund in the PRS scheme of another PRS Provider.

PRS Members are allowed to switch between funds in the scheme or transfer the accrued benefits to another PRS fund of another PRS Provider, subject to the terms and conditions as specified in the scheme’s disclosure document. Please read the scheme’s disclosure document before deciding to make a contribution. If you do not have a copy, please contact the PRS Provider to ask for one.

Transfers can only be instructed between Providers after the first year of subscription to the PRS from the date of first contribution.

A PRS Member may make a full or partial transfer from one or multiple funds managed by the Transferor Provider. PRS Members are to approach the Transferee Provider to complete a Transfer Form as well as other relevant forms. Request for transfer must be made in units and a PRS Member will not be required to indicate the breakdown on the number of units to be transferred from sub-account A and sub-account B respectively.

The allocation of units between sub-account A and sub-account B will be based on a 70-30 ratio whereby 70% of the units will be redeemed from sub-account A of the Transferor Fund(s) and allocated to sub-account A of the Transferee Fund(s), and 30% of the units will be redeemed from sub-account B of the Transferor Fund(s) and allocated to sub-account B of the Transferee Fund(s). In the event there are insufficient units in sub-account B to effect the transfer according to the 70-30 ratio, the Transferor Provider is permitted to redeem the remaining units from sub-account A of the Transferor Fund(s) to fulfil the transfer request and to transfer such proceeds to purchase units for sub-account A of the Transferee Fund(s).

For fees and charges on switching and transfer, please refer to the Providers page of this website under Providers & Schemes (Fees and Charges). Transferor Providers’ fees (which include transfer fees and redemption charge, where applicable) will need to be deducted from sub-account A of the Transferor Fund(s). For transfer from one or more funds, Transferor Providers’ transfer fees must be apportioned equally depending on the number of funds. For example, if there are transfer request from two funds, the transfer fee of RM50 is to be charged RM25 for each fund.

You may wish to make regular withdrawal or lump sum withdrawal. Request for withdrawals may be made in the following circumstances:

The following are not considered a withdrawal from a scheme:

- Exercise of cooling-off rights;

- Withdrawal / Redemption for the purpose of transfer to a scheme by another PRS Provider; or

- Exercising the right to withdraw due to changes in supplementary or replacement disclosures, such as the scenario described below:

-

After enrolling into a PRS fund, if the PRS Provider then submits a supplementary or replacement disclosure document for the fund to Securities Commission Malaysia for registration before the units are issued, the PRS Provider must notify you as soon as the document is registered. You will then be given 14 days to decide whether you would like to withdraw or stay invested.

Below are changes in a supplementary or replacement disclosure document which may affect your decision to stay invested in the fund;

-

-

-

- change in investment strategy of the fund;

- change in distribution policy of the fund; or

- change in minimum balance required for the fund.

-

-

- However, the right to withdraw in this instance does not apply if:

-

-

- a new fund was added to a master disclosure document;

- changes do not directly affect the fund you invested in;

- contribution was made on behalf of you by an employer; or

- you opted for the default option.

-

PRS Members aged 55 years and above may make retirement withdrawals free of the tax penalty.

Although lump sum withdrawals are permitted, members are encouraged to retain their savings for continuous investment under the respective Schemes.

Joining PRS