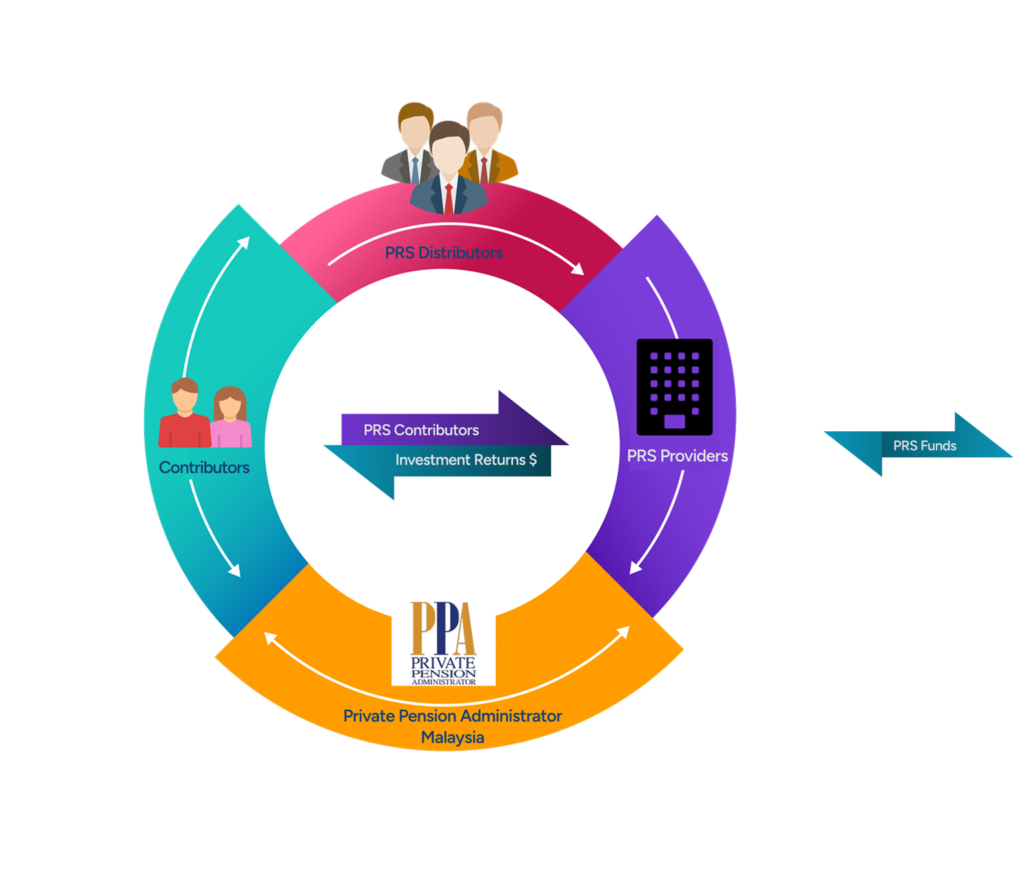

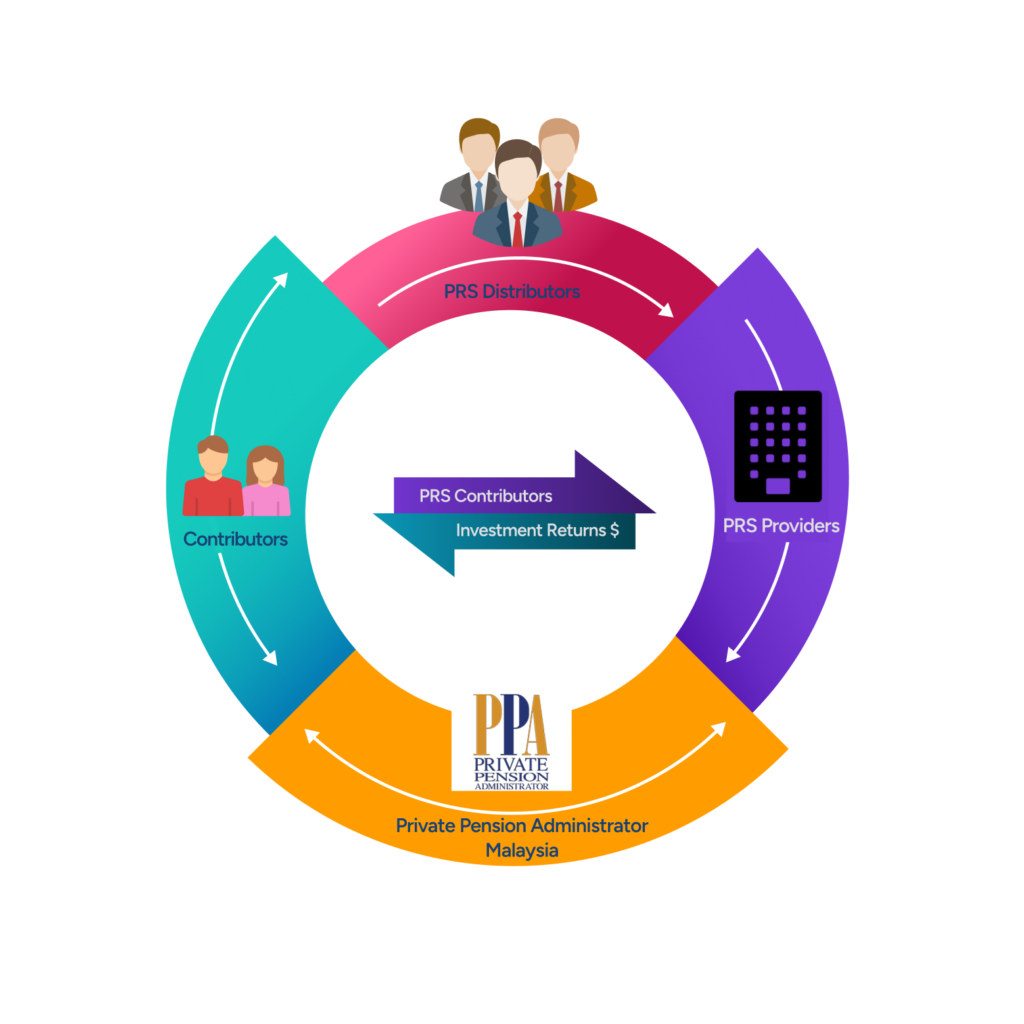

How PRS Works

To start your PRS savings, you may choose to make contributions directly to the PRS Provider or through their registered distributors. Once you have successfully started your PRS savings you are automatically given a PRS account.

PPA, as the central administrator for PRS will be administering your PRS account and will provide you an annual consolidated statement of your PRS account with the PRS Provider(s).

Who can contribute in the PRS ?

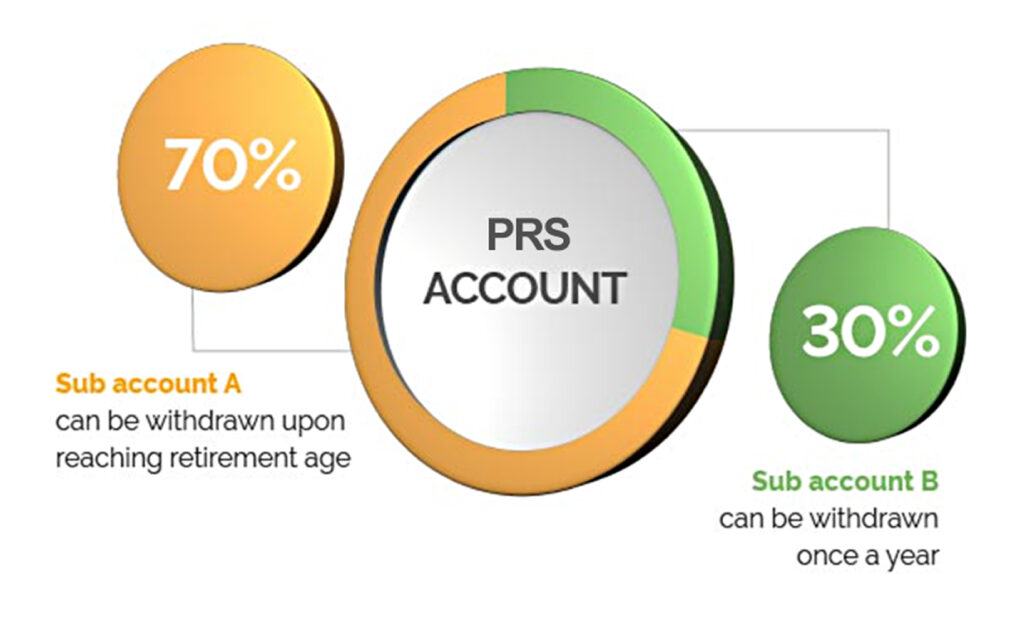

Any individual who has attained the age of 18 years as of the date of the account opening of a private pension account may make a contribution to any fund under the PRS. The PRS is offered to Malaysians and non-Malaysians as well. Contributions to any fund under the PRS will be maintained in two separate sub-accounts by the PRS Providers as follows:

70% in Sub-account A which is not available for pre-retirement withdrawal; and

30% in Sub-account B which would be available for pre-retirement withdrawal subject to payment of 8% tax penalty on the withdrawal sum.

Individuals have the option to contribute to more than one fund under a PRS scheme or to contribute to more than one PRS scheme, offered by different PRS Providers.

Being a voluntary scheme, there are no fixed amounts or fixed intervals for making contributions. You may wish to make regular contributions or lump sum contributions. Please note that there may be differences in the minimum initial contribution amount and subsequent contribution amount amongst the PRS Providers.

Once you have opened your PRS account, you could top up your contributions by using PRS Online from your smartphones, tablet or computer. Find out more about PRS Online.

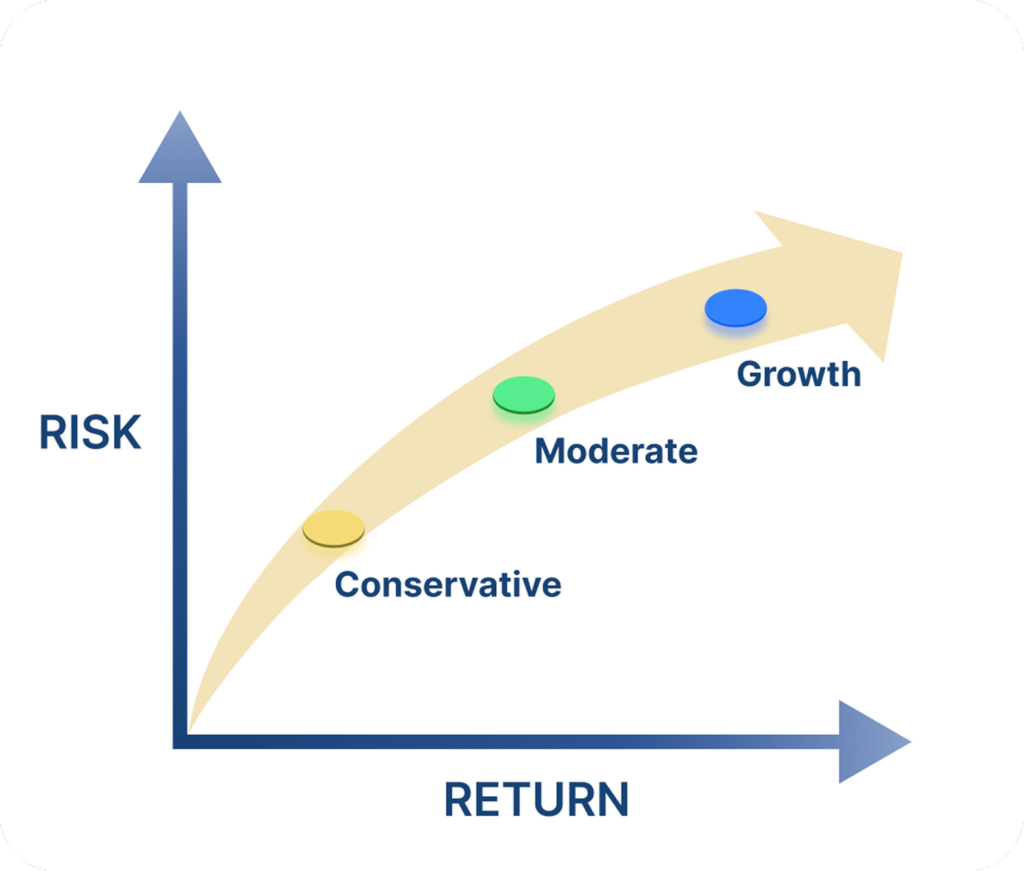

Investment Risks

When you invest in a PRS Fund, there are investment risks involved. These are general risks which you will be exposed to when investing in any of the PRS Funds as well as specific risks associated with the investment portfolio of each PRS Fund. Therefore you should consider the different type of risks that may affect you and the fund. These risks are disclosed in the PRS Scheme Disclosure Document or Product Highlights Sheet.

For a list of the PRS fund’s general and specific risks with your respective PRS Provider, please go to List of Schemes & Funds section. Alternatively, you may contact any of the PRS Providers and ask for a copy of their PRS Scheme Disclosure Document or Product Highlights Sheet.